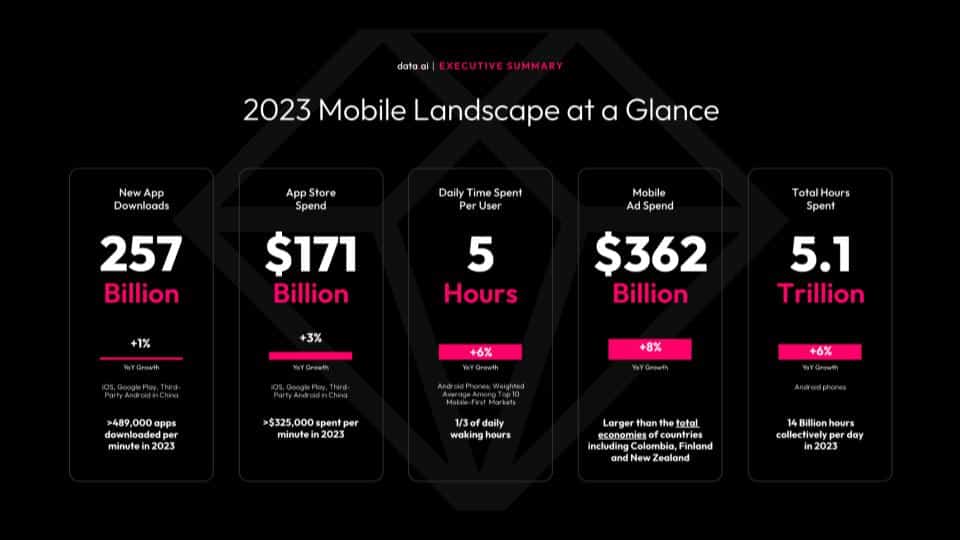

In 2023, the mobile app industry saw significant growth, with 257 billion new app downloads and users spending an average of five hours per day on their devices — a notable 6% increase from 2022. This surge in activity was driven by numerous factors, including the increasing availability of smartphones and tablets and the massive range of mobile apps available to consumers.

The financial sector also experienced remarkable mobile growth. In 2023, there were over 489,000 finance apps downloaded per minute, highlighting the growing demand for mobile financial services.

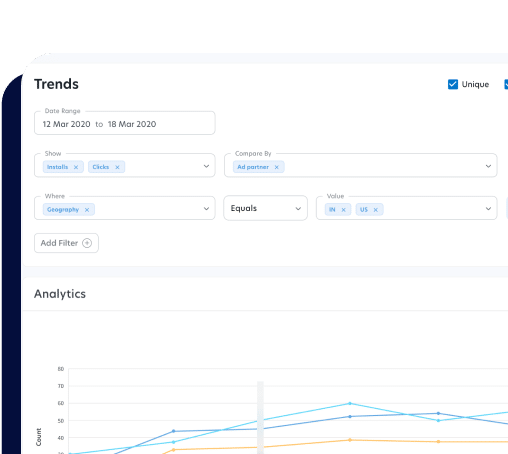

This blog delves into the latest insights from data.ai to uncover 2024’s finance mobile app trends, including growth drivers and patterns likely to shape the future of the industry.

2023 mobile landscape: usage, mobile-first markets, app spend, and monetization

Usage

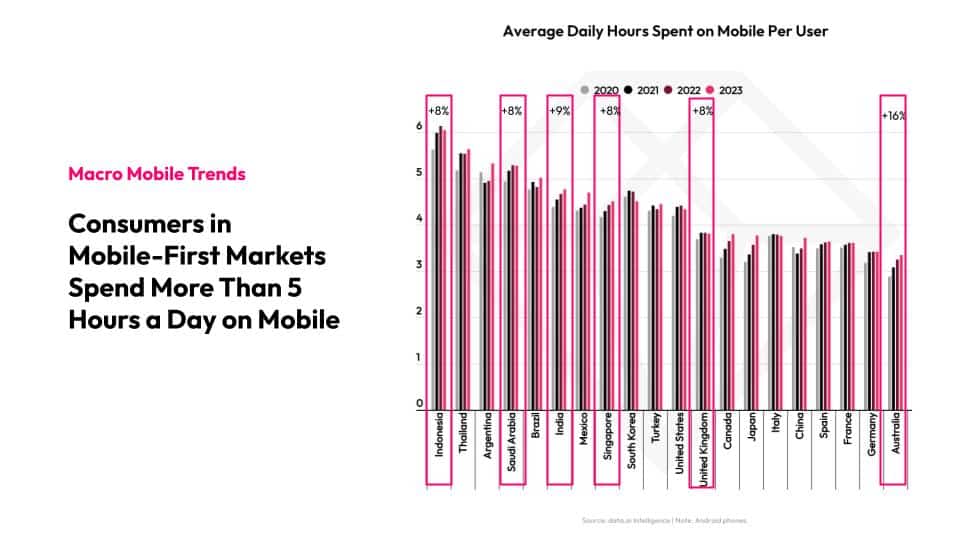

Mobile phone usage is on the rise in many parts of the world, particularly in Southeast Asia and the Middle East.

Key takeaways:

- Indonesia: Leads the pack in terms of daily mobile usage, with users spending over six hours per day on their phones. This represents an 8% increase compared to the previous period.

- Saudi Arabia: Shows continued growth in mobile usage, though at a slightly slower pace than previous years.

- India: Users spend an average of 4.7 hours per day on their phones, indicating year-over-year growth.

- Australia: Mobile usage in Australia is closer to European markets like the UK, with users averaging around 3.5 hours per day. However, Australia has seen a strong 16% increase in daily mobile usage.

Mobile-first markets

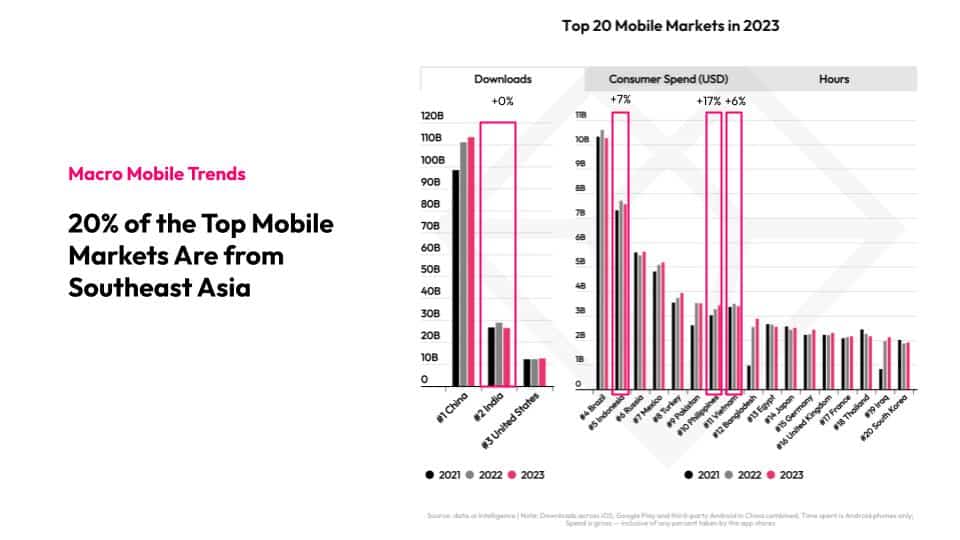

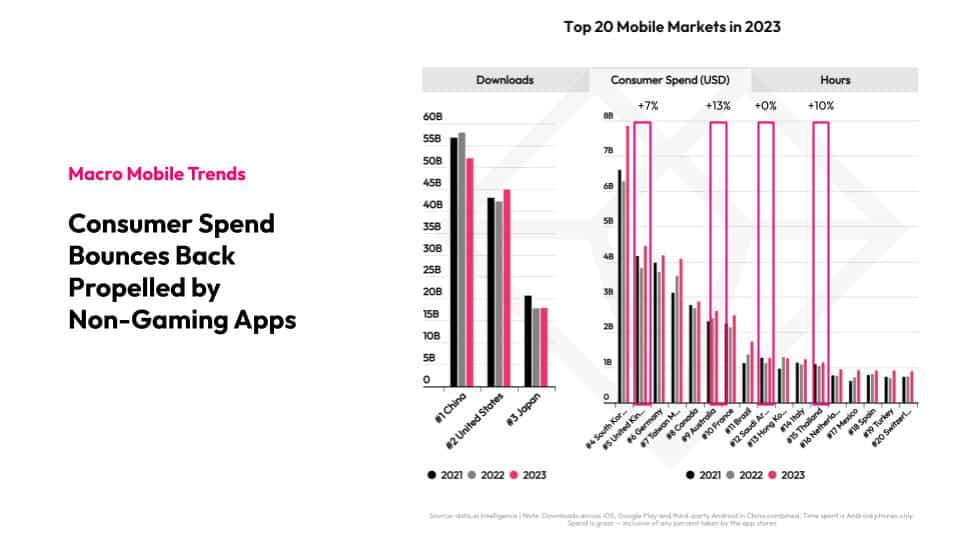

China, India, and the United States emerged as the leading mobile-first markets, determined by app downloads, consumer spend, and hours spent on mobile. However, it’s important to remember that download figures can be influenced by factors like population size and device penetration. While downloads offer insights into market demand, they don’t necessarily reflect app revenue or user engagement.

Key takeaways:

- Canada: Shows strong download numbers due to its large population size.

- U.S.: Despite being an early adopter of mobile technology, downloads in the U.S. have remained relatively stable, likely due to market saturation.

- Brazil: Ranks as the fifth-largest market by downloads.

- Southeast Asia: Both the Philippines and Vietnam appear among the top 20 mobile-first markets.

- Europe and Latin America: Several European and Latin American countries are also present in the top 20, including the UK (#16).

Consumer spend

In certain regions, namely Australia and Thailand, consumer spending in 2023 rebounded from its non-gaming app decline in 2022. Today, China, the U.S., and Japan lead the pack.

Key takeaways:

- China: Despite failing to rebound from 2022, China remains the leader in consumer spending, particularly when considering third-party app stores on Android.

- U.S.: Narrows the gap with China in consumer spending, despite its smaller population. This indicates a higher average spend per user in the U.S.

- Japan: Shows stable consumer spending year-over-year.

- UK: Experienced a decline in consumer spending in 2022, likely due to inflation and a stronger focus on gaming apps.

Time spent on mobile devices

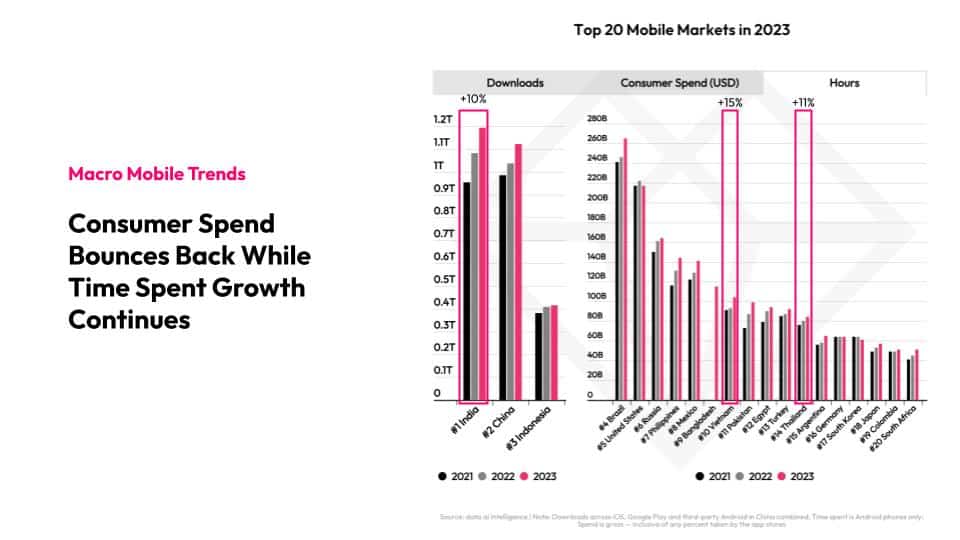

Globally, there was a 10% year-over-year increase in average time spent on mobile devices, with Indonesia, Saudi Arabia, and India emerging as the leading contributors. Other emerging markets saw particularly significant growth.

Key takeaways:

- Pakistan: Ranks 11th in terms of time spent, marked by a notable 14% year-over-year increase.

- South Africa: Despite ranking 20th, the country saw 13% growth in time spent.

- Southeast Asia: Leads in time spent growth, notably with Vietnam (15%) and Thailand showing significant increases. India, ranked 7th by time spent, also saw a 10% growth.

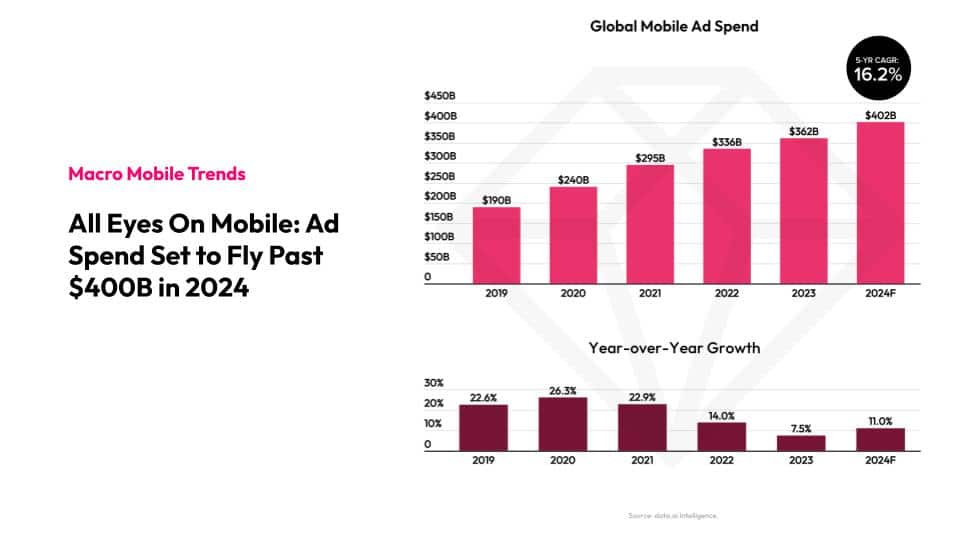

Mobile ad spend

With users’ increasing time spent on mobile devices, the importance of mobile advertising has surged. Global mobile ad spend is projected to hit $402 billion in 2024, marking an 11% year-over-year uptick. This growth marks a recovery from the sluggish pace seen in 2023, albeit still trailing behind pre-pandemic rates observed between 2019 and 2022.

The U.S., Japan, and China are expected to remain top spenders; though despite maintaining its position as a major player, the U.S.’s ad spend growth is expected to be moderate.

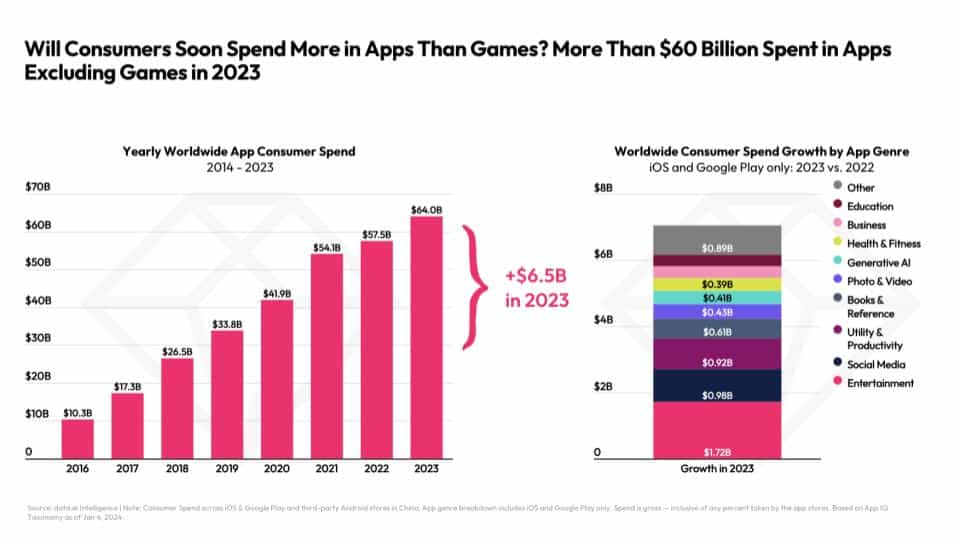

Monetization

There is a notable shift towards alternative revenue streams beyond traditional in-app purchases. Social media platforms are spearheading this trend with new monetization methods. For instance, platforms like TikTok enable users to directly tip their favorite content creators during live streams, while subscription services offer premium features or exclusive content for subscribers. Additionally, platforms like X provide verification badges for a fee, ensuring users’ authenticity. These developments coincide with a year-over-year growth in consumer spending in non-gaming apps, underscoring the rising prominence of this segment within the mobile app market.

User preferences are driving the demand for alternative monetization models, such as tipping and subscriptions, reflecting a growing emphasis on user engagement and creator support. The creator economy is flourishing as platforms facilitate direct compensation for content creators. This trend presents exciting opportunities for both social media platforms and content creators to explore new avenues for revenue generation and build sustainable financial models tailored to evolving user needs and preferences.

Finance app trends: Mobile banking, digital wallets, and beyond

Mobile banking and digital wallets

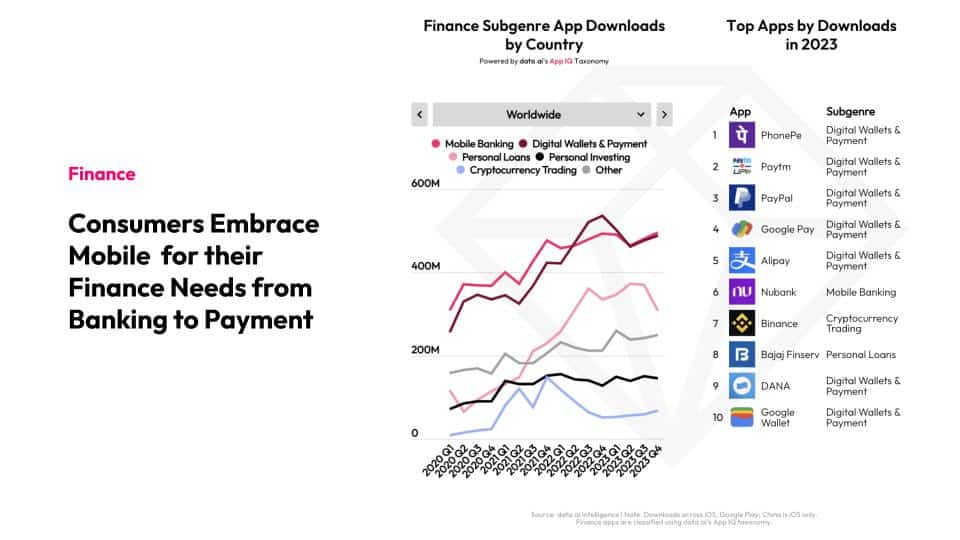

Mobile banking and digital wallet apps are witnessing significant growth fueled by consumers’ increasing reliance on mobile devices for financial transactions. Globally, mobile banking and digital wallets are the most popular financial app types, although regional variations exist due to financial regulations and market preferences. For instance, popular apps like AliPay in China and PhonePe in India cater to dominate user bases in their respective regions.

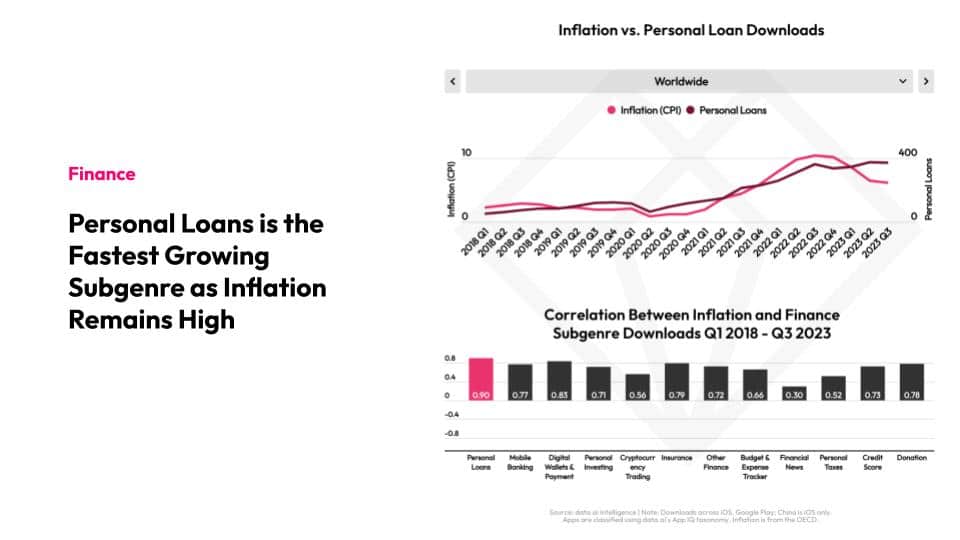

Personal loan apps

The fastest-growing subgenre of finance app downloads is personal loans. The surge in personal loan apps across various regions has a strong positive correlation with the Consumer Price Index (CPI), suggesting that as inflation increases and puts pressure on household budgets, people turn to personal loans to bridge financial gaps. This trend highlights the growing role of mobile financial services in providing users with access to credit, particularly during economic challenges.

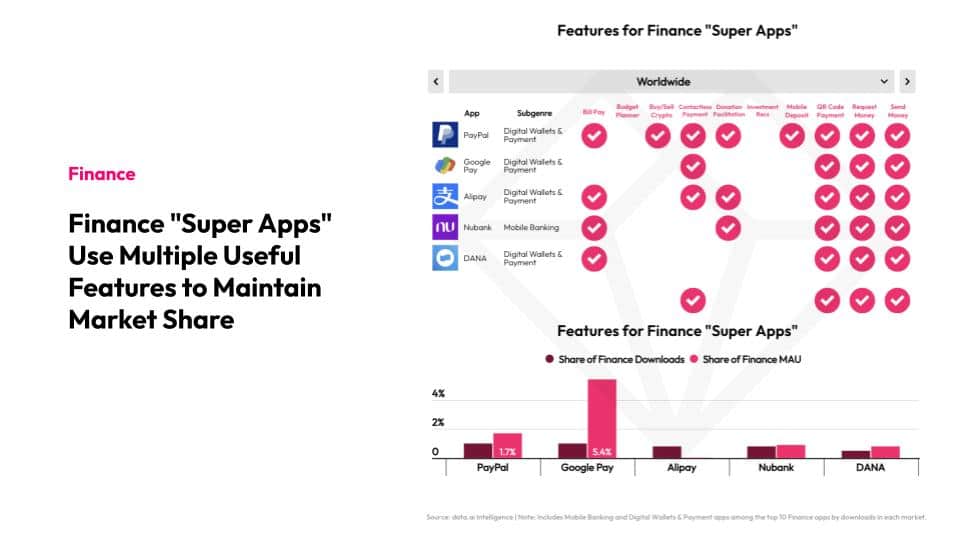

Super apps

“Super apps,” which aim to consolidate various financial services into a single platform, are increasingly prevalent in the finance sector. Popular apps like Alipay, PayPal, and Google Pay offer a wide range of financial features, including mobile banking and money transfer, while others even provide cryptocurrency trading. By allowing users to spend, request, invest, and save money in a single place, super apps enhance convenience and loyalty. Their rising popularity suggests a potential shift towards a more holistic approach to mobile finance management. However, regulatory hurdles may limit widespread adoption in certain regions.

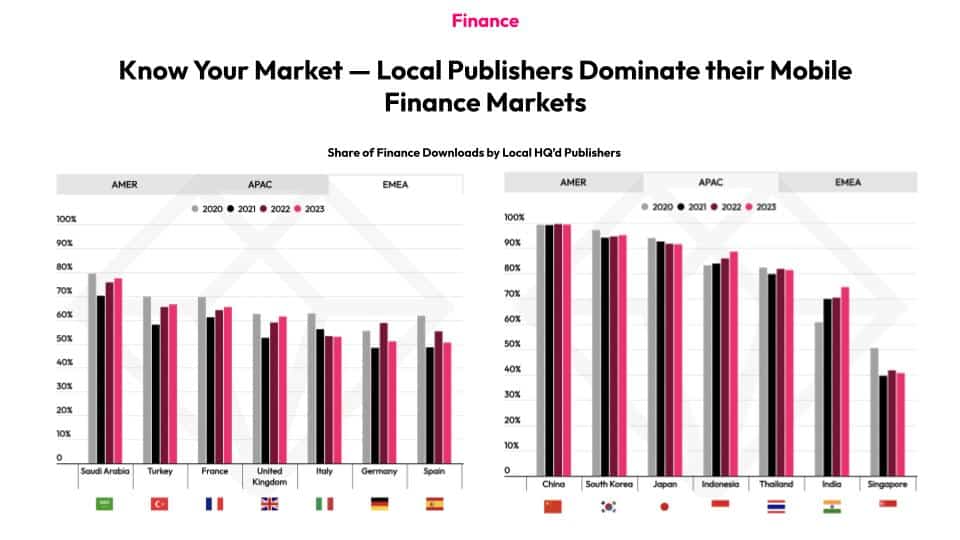

Local app dominance

There’s a notable prevalence of local publishers in the mobile finance market, driven by factors such as regulatory hurdles and cultural preferences. In regions like China, stringent regulations restrict foreign competition, giving local companies an edge. Success in these markets also hinges on brands’ abilities to optimize for local languages and cater to specific cultural nuances. Consequently, there is a higher concentration of local apps originating from countries like China, South Korea, and Japan. Understanding these factors is essential for foreign players looking to break into new markets.

Regional spotlights

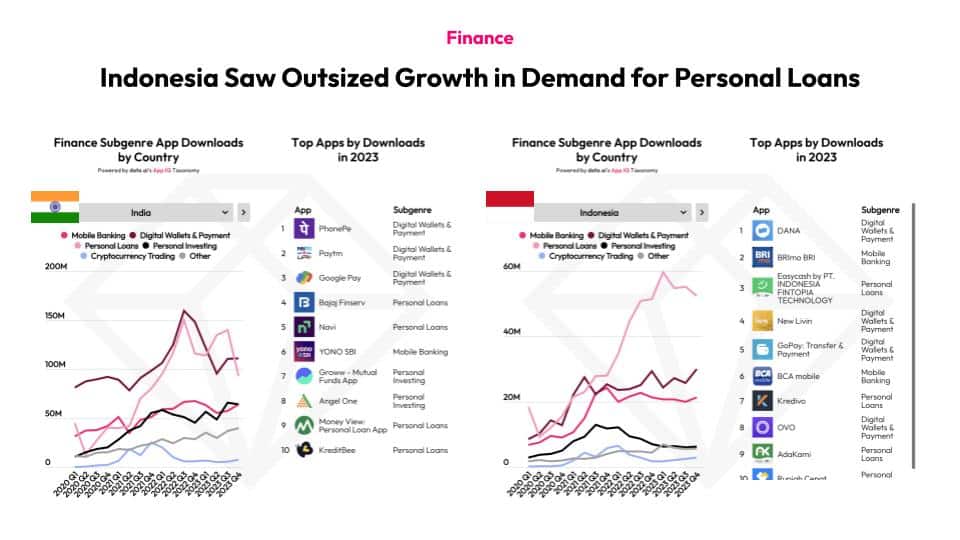

India and Indonesia: finance mobile apps

In both India and Indonesia, mobile banking and digital wallets reign supreme, comprising the majority of finance app downloads. However, there are notable shifts in user preferences within each market. India has witnessed a surge in personal loan apps, likely influenced by economic factors driving consumer behavior. Meanwhile, in Indonesia, digital wallets and payments remain dominant, with personal loans experiencing even higher growth and emerging as the leading subgenre within the finance category. These regional trends also manifest in the popularity of market-specific players such as Dana in Indonesia and PhonePe in India, catering to the respective user bases.

Looking ahead, we can anticipate mobile banking and digital wallets to continue to lead the finance app landscape in both markets, potentially followed by the growing prominence of personal loan apps. These trends underscore the impact of economic factors, regional regulations, and user preferences on shaping the app ecosystem in India and Indonesia.

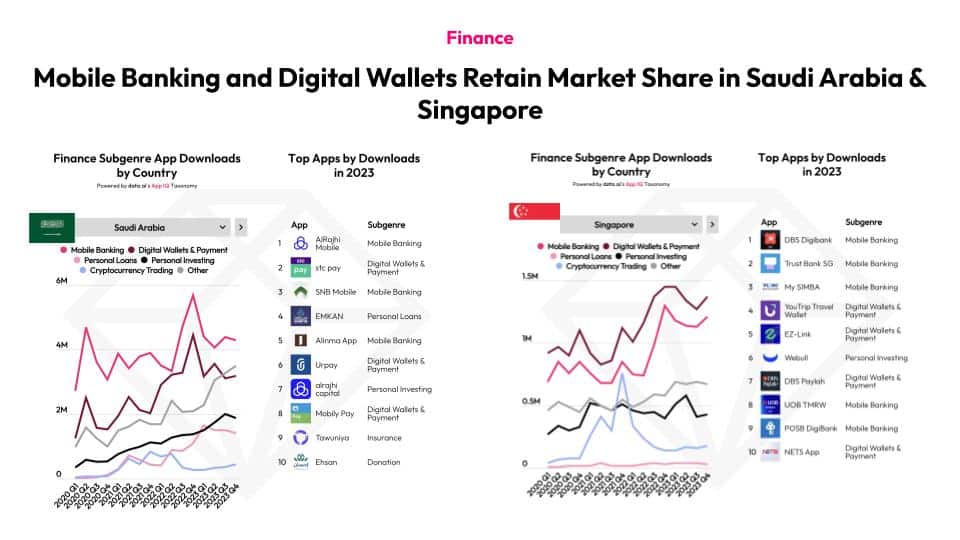

Saudi Arabia and Singapore: beyond mobile banking and wallets

In Saudi Arabia, the finance app landscape is marked by a diverse range of offerings, with insurance apps and donation platforms ranking among the top 10 downloaded apps.

The notable surge in “Others” downloads in late 2023 suggests an increasing presence of innovative financial services tailored for mobile users. Meanwhile, in Singapore, travel and wallet apps like YouTrip continue to dominate, underscoring the importance of the travel sector in the region. Despite experiencing a surge in crypto-related downloads in 2021 followed by a decline after the market crash, Singapore maintains a steady level of downloads in this category.

Across both countries, mobile banking and digital wallets hold significant sway, with these categories occupying a substantial portion of the chart. However, unique regional trends emerge: Saudi Arabia showcases a growing interest in insurance and donation apps alongside innovative financial services, while Singapore’s app landscape reflects the prominence of the travel sector alongside traditional finance tools.

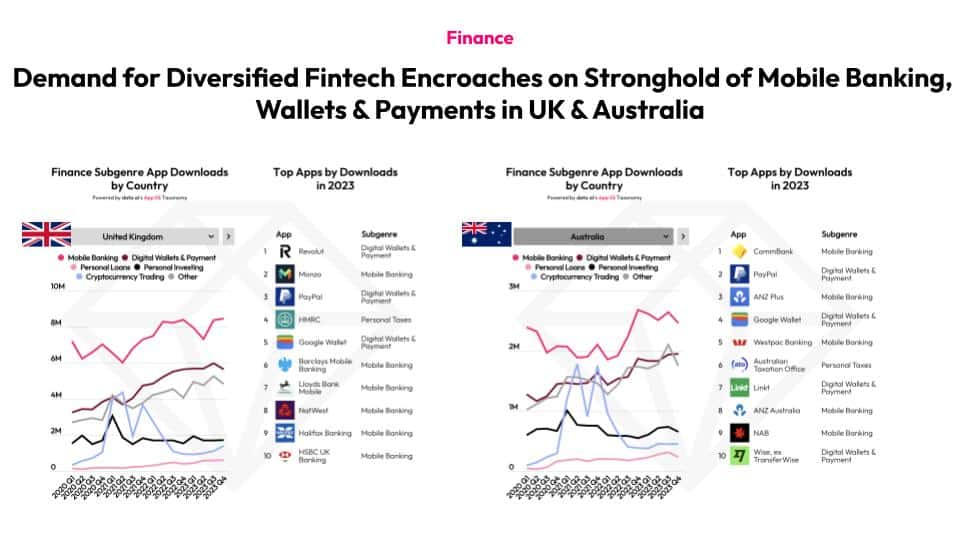

UK and Australia: fintech beyond mobile banking

In both the UK and Australia, mobile banking stands as the dominant force within the fintech landscape, maintaining its stronghold with a consistent lead in terms of downloads. However, alongside this steadfast presence, notable shifts are occurring in other sectors. In the UK, there’s a noticeable uptick in the popularity of donation apps, signaling a growing interest in charitable giving facilitated through digital platforms. Similarly, in Australia, diverse sectors such as insurance, savings, investment apps, and tax services are experiencing significant growth, reflecting evolving consumer preferences and needs. As these emerging sectors gain traction, they contribute to a broader and more diversified fintech ecosystem in both regions. While mobile banking continues to spearhead the industry, the rise of these alternative sectors suggests a potential shift towards a more multifaceted fintech landscape, offering users a wider array of financial services and options to meet their evolving needs and preferences.

Conclusion: A dynamic landscape

Mobile finance is undergoing a significant transformation in 2024. While mobile banking and digital wallets remain dominant, the rise of alternative monetization methods, regional variations, in-app preferences, personal loan apps, and the surge of super apps offering comprehensive financial services all paint a dynamic picture. Understanding these trends and the factors shaping them is crucial for businesses and users alike to navigate the evolving mobile finance ecosystem. For a deeper dive, tune into our on-demand webinar with data.ai.